Credit rating downgrade triggers warning signs for U.S.

Clip: 5/19/2025 | 4m 57sVideo has Closed Captions

Credit rating downgrade triggers warning signs for U.S. economy

The growing size of the U.S. debt, and the concerns over how much more it will increase, is very much on the minds of investors, markets and lawmakers. The developments were tied in part to Moody’s announcement that it was downgrading the U.S. credit rating over concerns about large annual deficits, debt and rising interest costs. Amna Nawaz discussed more with David Wessel.

Problems with Closed Captions? Closed Captioning Feedback

Problems with Closed Captions? Closed Captioning Feedback

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...

Credit rating downgrade triggers warning signs for U.S.

Clip: 5/19/2025 | 4m 57sVideo has Closed Captions

The growing size of the U.S. debt, and the concerns over how much more it will increase, is very much on the minds of investors, markets and lawmakers. The developments were tied in part to Moody’s announcement that it was downgrading the U.S. credit rating over concerns about large annual deficits, debt and rising interest costs. Amna Nawaz discussed more with David Wessel.

Problems with Closed Captions? Closed Captioning Feedback

How to Watch PBS News Hour

PBS News Hour is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipAMNA NAWAZ: The growing size of the U.S. debt and the concerns over how much more it will increase was very much on the minds of investors, markets and lawmakers today.

Stocks bounced back, but only after a rocky start to the day.

Meanwhile, the value of the dollar dropped and bond markets were under pressure.

Analysts said the developments were tied in part to Moody's announcement on Friday that it was downgrading the U.S. credit rating over concerns about large annual deficits, debt and rising interest costs.

For some explanation and perspective on what's happening here, I'm joined now by David Wessel, director of Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.

David, great to see you.

Let's start with the impact of that Moody's decision on Friday to downgrade the U.S. credit rating.

It seems like stock investors today seemed to shrug it off, but explain what we're seeing with the dollar and in the bond markets.

DAVID WESSEL, Brookings Institution: Well, listen, the -- what Moody's did was shine a flash light on something that any sophisticated investor and even some unsophisticated investors knew, that the U.S. is on an unsustainable budget trajectory.

After all, Moody's is one of three rating agencies, and the other two have previously, one as long as 2011, stripped the U.S. of the AAA rating.

I think what's happening is that, after sort of being ignored for a while, the markets, some of the press, the pundits and a few members of Congress are beginning to say, wow, we have a pretty big budget deficit.

We have a large and growing federal debt and Congress is on the verge of making it even worse.

And I think that's what the markets are focusing on.

AMNA NAWAZ: How much of what we're seeing right now in terms of warning signs has to do with that pending tax bill in Congress and also just the ongoing uncertainty around tariffs?

DAVID WESSEL: I think quite a bit.

So, despite all the rhetoric one hears from Congress about, oh, we need to do something about spending and we have too big a debt, the bill that the House is considering and will go to the Senate cuts taxes much more than it reduces spending.

Analysts, depending on how you look at the numbers, say it'll increase the federal debt by $2.5 trillion to $3.5 trillion over the next 10 years.

Depends whether you count interest or not in that calculation.

But I think also what global investors are saying is, maybe the U.S. isn't quite as stable as we thought.

There's challenges to the rule of law.

There's all the uncertainty about tariffs.

And they're saying maybe we shouldn't have all our money or the bulk of our money in the U.S. And that's why we think the dollar is falling.

People are buying less in the way of U.S. securities, because they have a little bit less confidence.

I don't think -- we're not at the risk of default.

It's not the end of the world.

But it's a warning sign that if we don't get our house together, the markets are going to charge us a higher interest rate to cover the risk.

AMNA NAWAZ: But, David, each time there were previous downgrades from the other two credit rating agencies, right, in 2011 and 2023, we heard concerns that investors would start to see the U.S. less as a safe haven for their investments, and that didn't happen.

They continued to put money into U.S. treasuries.

You think something's different this time?

DAVID WESSEL: We don't really know.

I mean, the credit rating agencies don't have that much clout.

People can look at the U.S. government through their own eyes.

I think what -- the fact that bond yields have gone up and the dollar has gone down is a very serious sign.

And it's different than what we have seen in the past.

And I also think that it's getting bigger.

The problem is getting bigger.

And, finally, maybe there's going to be some alternatives to the dollar.

One of the things that has kept us in good shape is there really wasn't anywhere else for big investors like the Chinese foreign exchange reserves to put their money.

But there is some speculation that maybe Europe is getting its act together and the European bond market may become an alternative.

And that's something that would give us competition that we haven't had.

So is this time different?

I don't really know.

But it's a warning sign that I don't think we should ignore.

AMNA NAWAZ: David, in 30 seconds or so, is this the kind of thing, especially when we're seeing pressure in the bond market, consumers are going to start to see show up in their lives in terms of mortgages or auto loans, credit cards?

DAVID WESSEL: Yes.

When the bond market gets a little skittish about the U.S. economy and our willingness to pay back our debts, they raise interest rates on U.S. treasuries.

And the interest rates on U.S. treasuries are a benchmark that affects what we pay on mortgages, credit cards, and auto loans.

So it may be only a little bit, but a little bit across the whole economy could be a significant hit.

AMNA NAWAZ: David Wessel of the Brookings Institution, always great to talk to you.

Thank you.

DAVID WESSEL: Thank you for having me.

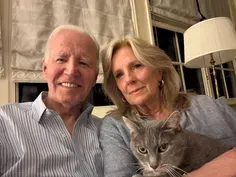

After Biden's diagnosis, a look at prostate cancer's impact

Video has Closed Captions

Clip: 5/19/2025 | 4m 58s | After Biden's diagnosis, a look at prostate cancer's impact on men in the U.S. (4m 58s)

Artist explores her Haitian heritage for inspiration

Video has Closed Captions

Clip: 5/19/2025 | 5m 13s | Artist Fabiola Jean-Louis explores her Haitian heritage for inspiration (5m 13s)

How cuts have hit nonprofits and the communities they serve

Video has Closed Captions

Clip: 5/19/2025 | 7m 22s | How federal funding cuts have hit nonprofits and the communities they serve (7m 22s)

Israel allows some aid into Gaza as it intensifies strikes

Video has Closed Captions

Clip: 5/19/2025 | 5m 29s | Israel allows 'minimal aid' into Gaza as it intensifies airstrikes and ground operations (5m 29s)

News Wrap: Trump may end protected status for Venezuelans

Video has Closed Captions

Clip: 5/19/2025 | 6m 28s | News Wrap: Supreme Court allows Trump to end temporary protected status for Venezuelans (6m 28s)

Tamara Keith and Amy Walter on Trump's 'big, beautiful bill'

Video has Closed Captions

Clip: 5/19/2025 | 9m 17s | Tamara Keith and Amy Walter on the battle over Trump's 'big, beautiful bill' (9m 17s)

What tariffs mean for the everyday products we rely on

Video has Closed Captions

Clip: 5/19/2025 | 8m 1s | What Trump's tariffs mean for the everyday products we rely on (8m 1s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipSupport for PBS provided by:

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...